UC Task Force Recommends Changes to Post-Employment Benefits

Mark Yudof

After more than a year of study, consultation and discussion, the Post-Employment Benefits Task Force has presented its recommendations for pension and retiree health benefit changes to University of California President Mark Yudof.

The task force recommends that UC:

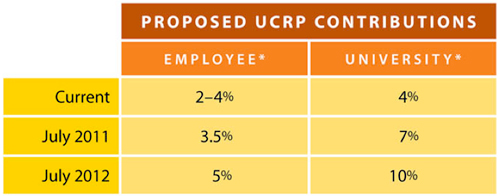

- Increase employer and employee contributions to the UC Retirement Plan (UCRP) to 10 and 5 percent, respectively, by July 2012.

- Add a new UCRP pension tier for employees who join UC after July 2013. Several options are proposed, but all raise the minimum retirement age from 50 to 55 and require faculty and staff to work longer to receive the maximum pension benefit.

- Change eligibility rules for retiree health benefits.

- Reduce, over time, UC contributions to retiree health insurance premiums to 70 percent of the cost.

The task force also recommends excluding employees who are nearing retirement from the changes in eligibility for retiree health care. Roughly 40 percent of current faculty and staff would be “grandfathered” in under the recommendations.

As has been previously reported, none of the proposed changes will alter the vested pension benefits that faculty and staff have already accrued. Those benefits are guaranteed under state law. In addition, most other proposed changes would be subject to collective bargaining for union-represented employees.

“The task force has done a tremendous job in listening to the needs of the University and its people as they developed these proposals,” Yudof said. “I am now asking members of the administration to continue the consultation process with faculty, staff and retirees in advance of my final recommendations to the Regents.”

Yudof has asked Provost Lawrence Pitts, who chaired the task force steering committee; Nathan Brostrom, executive vice president of business operations; and Peter Taylor, chief financial officer, to continue the consultation process.

The UC Board of Regents, which has final authority over UC’s retirement plan, is expected to vote on UCRP contribution levels at its September meeting and take up other aspects of the plan at subsequent meetings in the fall.

Learn More, Get Involved,

Visit

Future of UC Retirement Benefits

Future of UC Retirement Benefits

- Read the task force’s report

- Find out what’s not changing

- See how UC’s retirement compares

- Submit a comment or question

- Watch live webcast of town hall on September 24

Attractive, Sustainable Benefits

With the University facing rising costs for pension and retiree health benefits and a growing retiree population, Yudof formed the task force in February 2009 and charged it with developing recommendations for competitive pension and retiree health benefits that would be financially sustainable over the long term.

The University already has a $21 billion unfunded liability for its retiree health and pension benefits, according to UC officials. Within five years, that unfunded liability is projected to grow to $40 billion – twice the current size of the entire UC budget.

The task force has approached the problem by developing recommendations that reward long service to the University and encourage employees to retire later and closer to the time they are eligible to receive Social Security benefits, said Randy Scott, executive director of talent management and workforce development and UC staff lead on the project. On average, faculty retire at age 66 and staff retire at about age 60, he noted.

The task force also was mindful of how important UC’s post-employment benefits are to faculty and staff, Scott said. Surveys and other feedback confirmed the task force’s view that retirement benefits are one of the key reasons that employees stay at UC. The task force sought to develop recommendations that would preserve that, he said.

Increasing UCRP Contributions

The Regents at their September meeting is expected to discuss and vote on the task force recommendation for increasing both employee and employer contributions to the UCRP for the next two fiscal years.

The recommendations call for moving quickly towards a contribution level of 17.6 percent of payroll, the amount necessary each year to cover the cost of future benefits incurred for that year.

* Portion of employee earnings directed to the UCRP. (See larger)

UC and employee contributions are likely to rise again in 2013 by another 2 percent, but if other recommendations are followed, employees by then may have the option of enrolling in a new pension tier that requires lower contributions but also has a reduced benefit.

UCRP Tier for Employees

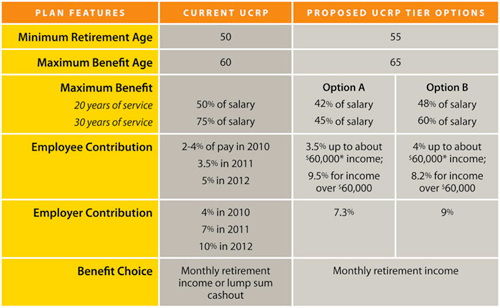

The task force also calls for a different pension tier for UC faculty and staff who join the University after July 2013. Current employees could also have a one-time option of joining the new tier.

While the task force agreed on the concept and many of the features of a new tier, they did not reach consensus on some issues, including contribution rates. As a result, the group put forward two options.

The least expensive option would require the University and its employees together to contribute about 12 percent of annual pay, while the task force’s second option would cost about 14 percent, compared with the current cost of 17.6 percent.

The president has also agreed to look at a third option, one that the task force steering committee thought was too costly. It would require the University and its employees together to contribute about 15 percent of pay, but would more closely match the current pension in terms of benefits.

Under the options advanced by the task force, employee contributions to UCRP would be 3.5 percent to 4 percent of pay on an amount determined by the Social Security Administration – currently about $60,000 – and 8.2 to 9.5 percent of pay for any portion of wages over that amount. UC would contribute between 7 percent and 9 percent. The percentage range reflects the differences between the two options.

Both task force proposals integrate UC’s pension with Social Security benefits to ensure long-term employees can retire with up to 100 percent of their income when UCRP and Social Security benefits are combined.

Many retirement experts say 80 percent of income is the amount needed to maintain one’s current lifestyle after retirement. By coordinating the UCRP tier with Social Security benefits, UC would be able to reduce its pension costs while ensuring that faculty and staff would have sufficient retirement income when Social Security, UCRP benefits and retirement savings are combined, task force members said.

The chart below offers a quick comparison of the plan features for the current UCRP plan and the proposed options for a new tier.

* This amount is determined by the Social Security Administration and is adjusted annually. (See larger)

Retiree Health Insurance

In the area of retiree health insurance, the task force recommends changes to eligibility rules and to the amount the University contributes to the cost of health insurance premiums.

Under the proposed changes, those who retire between ages 50 and 56 with 10 years of service would still be eligible for UC-sponsored group health insurance plans, but would pay the full premium cost.

Eligibility for a UC contribution would be determined by a graduated formula based on years of service and employee age at retirement, beginning with UC offering a 5 percent contribution to those who retire at age 56 with 10 years of service.

An employee who retires at age 65 with 20 years of service would be eligible for 100 percent of the UC contribution.

Under current and future eligibility rules, employees must be enrolled in UC-sponsored health insurance at the time of retirement to be eligible to continue participation as a retiree.

The task force recommends that UCRP members with at least five years of service be grandfathered in under current eligibility rules if their age plus years of service is equal to 50 or greater. Under those guidelines, roughly 40 percent of all UCRP members would fall under the current eligibility rules.

Gradual Increase in Cost-sharing

Current and future retirees would gradually pay more for retiree health insurance, while UC would reduce its share by about 3 percent per year under a task force proposal for predictable, phased-in changes.

Under the task force proposal, UC’s contribution would level off at 70 percent of the total premium. UC currently contributes about 89 percent of the cost of retiree health insurance premiums.

This recommendation does not need approval from the Regents, and UC likely will begin reducing its share of retiree health premiums in 2011. Retirees would be notified of increased premiums this fall during Open Enrollment.

Protections for Retirees without Medicare

UC would moderate the effects of reduced contributions for retirees who are not eligible for Medicare.

Premiums for retirees over age 65 who are not covered by Social Security and are not otherwise eligible for Medicare would be the same as the rates for employees who earn between $46,001 to $92,000 per year. UC has typically contributed about 88 percent of the cost of premiums for employees in that salary band.

“Retirees over 65 not eligible for Medicare have saved the University money over the years because UC did not pay into Social Security for them,” said Scott. “The retiree health work group and the task force feel strongly that we should make every effort to mitigate the impact of reduced contributions on these retirees.”

For retirees under the age of 65 who are not yet eligible for Medicare, the task force recommends that their health premiums be blended with those paid by active employees.

Because retirees tend to use their health benefits more than employees, the cost of health insurance for this group is more expensive. By including early retirees in the larger pool of UC employees, the University would be able to pass along a lower premium.

Next Steps

With the task force’s work complete, the next steps involve further consultation with faculty, staff, retirees and the Regents.

“I anticipate that the report and its recommendations will spark extensive discussions,” Pitts wrote in a letter to Yudof that accompanied the task force report. “It is imperative for us to adopt a plan that will provide appropriate benefits at a cost that is sustainable in the decades ahead.”

Source: UC Office of the President

Editor’s note: UCSF Today will post select stories by the UC Office of the President (UCOP) staff as well as original stories that are specific to UCSF as necessary. In addition, these stories will be combined together on the UCSF budget website under the new section for Post-Employment Benefits.

Related Links:

UC to Consider Proposed Changes to UC Retirement Benefits

UCSF Today, August 27, 2010